邮政e捷贷能贷多少钱

01

资本方

央行宣布,为了保持在季度末的稳定流动性,2021年9月28日,中国人民银行通过利率招标方式进行了人民币1000亿元的反向回购。今天没有反向回购到期,净投资为1000亿美元。

今天,基金的整体结构趋同,本月内放松,本月内收紧。在早盘交易中,大银行的股份制融资较为谨慎,未来14天有少量融资。银行的隔夜需求快速且持平,在14天内整个月略有累积。非银行开户的跨月报价在7天内为4.3-4.5%,在14天内为3.8-3.9%,在21天内为3.4%,在10天内隔夜2%%uff0c,全月需求强劲。在部分融通头寸被清算后,价格进一步上涨。14天内,3.9-4.0%%uff0cbid疲惫不堪,观望情绪强烈,价格上涨乏力。接近3.8-3.85%%u9644。在午盘交易后,该月进一步放松。银行隔夜交易接近1.7%%u9644,加权交易在整个月的14天内进行,大量3.8%的非银行融资在整个月的14天内完成,投标在3.7-3.75%%uff0c7天和4.1-4.2%%u6210天内完成,直到当天结束,没有波动。

邮政e捷贷能贷多少钱

02

一级市场

利率

21农发清发100(增发5),期限1Y,规模30,中标利率2.374,全场倍数4.59,边际倍数1.43

21农发清发101(增发2),期限3Y,规模20,中标利率2.8512,全场倍数5.05,边际倍数1.19

21农发清发03(增发9),期限2Y,规模30,中标利率2.5741,全场倍数5.32,边际倍数6.95

21农发清发04(增发6),期限7Y,规模40,中标利率3.215,全场倍数3.35,边际倍数1.18

CP

21昆明交投SCP002,0.74Y,6亿,AAA,地方国有企业,【4.06】

21江西建材SCP003,0.25Y,5亿,AA,地方国有企业,【3.3】

21方洋SCP002,0.49Y,04亿,AA,地方国有企业,【4.94】

21连云工投SCP001,0.74Y,5亿,AA,地方国有企业,【5.5】

21青山湖科CP002,1.00Y,2亿,AA,地方国有企业,【2.98】

21盐城城南CP001,1.00Y,5亿,AA,地方国有企业,【3.3】

21孝感城投CP003,1.00Y,4亿,AA,地方国有企业,【3.45】

MTN

21贵州交通MTN003,3.00Y,10亿,AAA,地方国有企业,【4.4】

21华电股MTN004,5.00Y,18亿,AAA,中央国有企业,【3.57】

21长发集团MTN002,32Y,010亿,AAA,地方国有企业,【5】

21福州交投MTN001,32Y,2.5亿,AAA,地方国有企业,【3.4】

21恒邦冶炼MTN001,21Y,5亿,AA,地方国有企业,【4】

21宏泰国资MTN002,32Y,10亿,AA,地方国有企业,【4.2】

21福瑞能源GN002(革命老区),3NY,10亿,AAA,中央国有企业,【3.85】

21福瑞能源GN003(革命老区),3NY,10亿,AAA,中央国有企业,【3.88】

企业债

无

周三簿记企业债

1、21焦作投资小微债01,55亿,32年,AA/AA,国泰君安证券,无,4.8%,2-4PM

03

二级市场

国债

国债期货全天呈下行趋势,午后短暂拉升,各期限小幅收跌。主力合约T2112收跌0.09%,收在99.715,TF2112收跌0.07%,收在100.960,TS2112收跌0.01%,收在100.740。

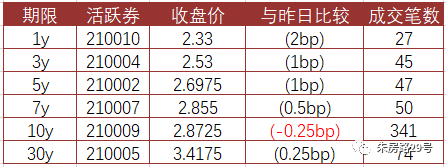

国债成交比较冷清,收盘各期限收益率上行1bp左右,短券表现更弱。具体来看,210002上1bp,收在2.6975,210009小幅下0.25bp,收在2.8725。

具体成交,

10y210009tkn2.875,2.87,2.88,2.8725下0.25bp

邮政e捷贷能贷多少钱

金债

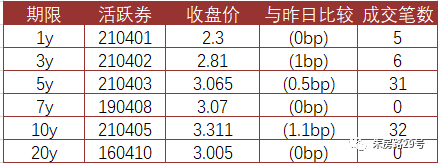

金债交投依然清淡,各期限收益率收盘整体上行1bp左右,同样短券表现较差。具体成交价格方面,210203上1bp,收在2.985,210205上0.75bp,收在3.215。

具体成交

5y210203tkn2.975,2.975,2.99,2.985上1bp

10y210210tkn3.2075,3.2075,3.221,3.215上0.75bp

国开

邮政e捷贷能贷多少钱

非国开

邮政e捷贷能贷多少钱

短融

周二短融整体成交量一般,AAA占比上升,3M-6M买盘多以基金和券商资管为主,成交在2.68-2.82收益区间,加点成交。临近季末资金跨季困难,卖盘存在缺少跨季资金选择卖出13D-17D跨季期限短债平头寸为主的操作,均加大点成交,成交在3.2-3.5收益区间。

AAA方面,

13D21华电SCP008AAA/03.2(34.5bp)

13D21物产中大SCP004AAA/03.5(47.5bp)

14D21中泰证券CP002AAA/A-13.2(8bp)

14D21首开SCP001AAA/03.5(54.3bp)

14D21华电江苏SCP024AAA/03.4(41.3bp)

14D21招商证券CP008BCAAA/A-13.2(12.1bp)

15D21国信证券CP008AAA/A-13.2(10bp)

15D21天津轨交CP005AAA/03.3(28.5bp)

15D21银河证券CP006AAA/A-13.3(20bp)

15D21银河证券CP006AAA/A-13.25(15bp)

15D21兴泰金融SCP001AAA/03.5(35.2bp)

16D21合建投SCP003AAA/03.4(58.1bp)

16D21东航股SCP010AAA/03.15(20.2bp)

16D21首钢SCP005AAA/03.4(39.2bp)

17D21张江集SCP004AAA/03.3(46.8bp)

17D21大唐集SCP006AAA/03.2(33.6bp)

17D21华能SCP010AAA/03.18(31.6bp)

21D21中信建投CP010BCAAA/A-13.2(12.9bp)

21D21招商证券CP009BCAAA/A-13.2(12.9bp)

21D21中seSCP004AAA/03.3(6.1bp)

21D21东吴证券CP007AAA/A-13.2(8.7bp)

23D21鲁高速股SCP007AAA/03.18(14.6bp)

27D21北控集SCP001AAA/02.9(3bp)

27D21南通经开SCP002AAA/03.2(18.2bp)

28D21华能集SCP018AAA/03.2(33bp)

28D21中国铜业SCP002AAA/03.2(15.1bp)

30D21中信建投CP012BCAAA/A-13(0.7bp)

31D21国信证券CP009AAA/A-13(1.5bp)

31D21沪机场股SCP005AAA/03.03(16.2bp)

31D21东财证券CP005AAA/A-13.02(-2.7bp)

35D21江西交投SCP001AAA/03.08(14.6bp)

38D20晋煤CP007AAA/A-13.3(6.8bp)

42D21京城建SCP003AAA/02.9(-1.9bp)

45D21中铝集SCP005AAA/03.01(9.2bp)

50D21国投交控SCP002AAA/02.85(0bp)

51D21东吴证券CP008AAA/A-12.87(-0.2bp)

58D21江北建投SCP004AAA/03(5.1bp)

59D21宁沪高SCP025AAA/02.61(-8bp)

69D21汉江国资SCP002AAA/02.85(0.9bp)

70D21南航股SCP024AAA/02.63(-0.3bp)

73D21宁河西SCP001AAA/02.85(2.1bp)

73D21中交路桥SCP001AAA/02.95(26.5bp)

73D21龙源电力SCP022AAA/02.62(-0.5bp)

73D21沪电力SCP011AAA/02.63(0.5bp)

73D21南通城建SCP005AAA/02.87(4.1bp)

77D21北京国资SCP001AAA/02.55(-0.4bp)

78D21中交路桥SCP002AAA/02.9(22.4bp)

80D21浪潮电子SCP001AAA/02.82(1.6bp)

85D20华阳新材CP020AAA/A-14.12(-34.1bp)

86D21晋能电力SCP003AAA/02.96(5.9bp)

87D21深圳地铁SCP001AAA/02.55(-11.5bp)

90D21国电南瑞SCP004AAA/02.68(6.9bp)

91D21荣盛SCP004AAA/03(9.9bp)

92D21福新能源SCP002AAA/02.7(8.9bp)

94D21中化股SCP014AAA/02.55(-6.2bp)

103D(休1)21津城建SCP031AAA/03.55(13.9bp)

105D21中化工SCP012AAA/02.93(24.9bp)

107D21广核电力SCP005AAA/02.75(17.5bp)

110D(休1)21京国资SCP004AAA/02.85(13.2bp)

112D21晋能电力SCP005AAA/03.08(15bp)

115D21津城建SCP053AAA/03.55(7.3bp)

118D21联通SCP003AAA/02.73(16.2bp)

119D21船重SCP001AAA/02.72(6.6bp)

133D21津城建SCP039AAA/03.63(-0.9bp)

147D21深圳地铁SCP003AAA/02.8(6.2bp)

150D21宁沪高SCP032AAA/02.8(5.1bp)

162D21招商蛇口SCP006AAA/02.8(0.8bp)

164D21广核电力SCP003AAA/02.82(6.8bp)

169D21苏国信SCP019AAA/02.8(3.5bp)

172D(休2)21赣国资CP001AAA/A-12.9(2.8bp)

174D21津城建SCP050AAA/03.9(-2.5bp)

176D21云建投SCP005AAA/05.2(2.3bp)

177D21港兴港投SCP004AAA/03.89(-2.5bp)

177D21港兴港投SCP004AAA/03.9(-1.5bp)

177D21大唐发电SCP007AAA/02.78(0bp)

178D21国联SCP006AAA/02.9(2.1bp)

178D21陕延油SCP005AAA/02.85(3.1bp)

179D(休2)21洪市政SCP005AAA/02.89(4.2bp)

212D21苏国资SCP003AAA/02.85(7.4bp)

230D21陕延油SCP008AAA/02.9(4.8bp)

234D21电网CP002AAA/02.8(2.4bp)

234D21平安租赁CP005AAA/A-13.15(9.8bp)

236D(休1)21复星高科SCP005AAA/05.1(5.6bp)

254D21陕煤化CP001AAA/02.93(1.4bp)

259D21荣盛SCP007AAA/03.35(0.4bp)

262D21深圳地铁SCP006(绿se)AAA/02.81(-0.3bp)

262D21中铝集SCP007AAA/02.93(1.3bp)

332D21晋能煤业CP002AAA/03.41(2.9bp)

337D21电网CP009AAA/02.82(1.8bp)

AA方面,

15D20山煤CP004AA/A-13.7(22.2bp)

56D21淮北建投SCP001AA/04(-17.1bp)

62D21江岸国资SCP001AA/02.95(-0.2bp)

86D21航天电子SCP002AA/02.78(0.9bp)

88D(休2)21嘉公路SCP001AA/02.9(0.6bp)

102D(休2)21扬州经开CP001AA/A-12.99(4.3bp)

107D21海安开投CP001AA/A-13.95(0.6bp)

171D21嘉兴现代SCP001AA/02.98(3.9bp)

214D(休5)21东台城投CP001AA/A-14.59(-0.6bp)

220D21东台城投CP001AA/A-13.15(-144.6bp)

251D21镇江城建SCP020AA/04.5(-8.3bp)

AA方面,

139D21水电顾问SCP001AA/03.2(-0.4bp)

154D21南昌金开SCP002AA/03.73(-1.1bp)

中票

中票成交活跃度一般,继续多以3年内期限AAA评级成交为主,高评级占比上升,买盘多以券商和基金为主,成交在2.78-3.28收益区间,加点成交。

AAA方面,

17D18中化工MTN003AAA/AAA3.1(8.3bp)

36DN16晋能MTN003AAA/AAA4(34.1bp)

40D(休1)16保利地产MTN001AAA/AAA2.87(-3.9bp)

41DNY18东南国资MTN003AAA/AAA3.12行权(-0.8bp)

55D18中远海控MTN001AAA/AAA2.83(4.2bp)

69DN18锡产业MTN004AAA/AAA3.1(2.4bp)

70D18国新控股MTN004AAA/AAA2.65(8.1bp)

76DN18陕高速MTN004AAA/AAA3.1(1.8bp)

80DN18扬子国资MTN002AAA/AAA3.07(-0.9bp)

80DNY18扬子国资MTN002AAA/AAA3.07行权(-0.9bp)

89D(休1)18上海电气MTN001AAA/AAA3.03(5.9bp)

117D(休1)19中电信MTN001AAA/AAA2.75(18.7bp)

161D17光大集团MTN002AAA/AAA2.78(3.5bp)

173D(休1)19南电MTN004AAA/AAA2.7(-3.6bp)

173D(休1)19中电信MTN002AAA/AAA2.71(-2.6bp)

184D17河钢集MTN003AAA/AAA3(-3.6bp)

195DN19晋焦煤MTN001AAA/AAA3.25(5.4bp)

205D17招商局港MTN001AAA/AAA2.86(1.7bp)

205D17招商局港MTN001AAA/AAA2.84(-0.3bp)

207D(休2)15津城建MTN001AAA/AAA4.07(1.6bp)

210D19吉利MTN001AAA/AAA3.07(1.5bp)

244D19闽西兴杭MTN001AAA/AAA2.9(-1.5bp)

264D(休1)19汇金MTN011AAA/AAA2.8(2bp)

265D12中船MTN1AAA/AAA2.86(0.3bp)

279D19鲁钢铁MTN002AAA/AAA3.1(5bp)

279D19中石油MTN003AAA/AAA2.81(2.8bp)

285D(休1)17苏轨交MTN001AAA/AAA2.89(6bp)

287D17华能MTN001AAA/AAA2.8(-0.1bp)

322DN17成交投MTN001AAA/AAA3.25(2.6bp)

343D17南通城建MTN001AAA/AAA2.95(-0.8bp)

360D19南电MTN007AAA/AAA2.82(1bp)

363D19柳钢集团MTN002AAA/AAA3.25(-0.3bp)

1.08Y19国电MTN004AAA/AAA2.91(6bp)

1.08Y19国电MTN004AAA/AAA2.85(0bp)

1.15Y19汇金MTN019AAA/AAA2.84(0.9bp)

1.16Y15甘公投MTN002AAA/AAA3.52(11.1bp)

1.16Y17粤电MTN002AAA/AAA2.86(-0.3bp)

1.28Y20越秀交通MTN001AAA/AAA3(3.9bp)

1.33Y21复星高科MTN001AAA/AAA6.3(16.9bp)

1.36Y18赣铁MTN001AAA/AAA3.07(4bp)

1.41Y16神华MTN002AAA/AAA2.92(0.3bp)

1.43Y(休1)20三峡GN001AAA/AAA2.84(-3.2bp)

1.46Y20绿城房产MTN002AAA/AAA3.29(1.3bp)

1.46Y18宁河西MTN002AAA/AAA3.1(4.2bp)

1.47Y(休1)18川交投MTN003AAA/AAA3.1(4bp)

1.49Y(休1)21电网GN002AAA/AAA2.84(-4.1bp)

1.5Y18金融街MTN001BAAA/AAA3.06(5.1bp)

1.53Y20国新控股MTN002AAA/AAA2.99(4.7bp)

1.54Y20中电投MTN006AAA/AAA2.96(1.4bp)

1.55Y20中国一汽MTN001AAA/AAA3.02(-0.1bp)

1.55Y18广州地铁MTN002AAA/AAA2.94(-0.4bp)

1.55Y(休1)18浙能源MTN002AAA/AAA2.95(0.3bp)

1.56Y18京国资MTN001AAA/AAA3(5.4bp)

1.56Y20汇金MTN005AAA/AAA2.9(0.7bp)

1.58Y18京国资MTN002AAA/AAA3(5bp)

1.59Y20中石油MTN005AAA/AAA2.91(1.4bp)

1.59Y20中石油MTN004AAA/AAA2.88(-1.6bp)

1.61Y20中银投资MTN001AAA/AAA3.08(1.9bp)

1.62Y21华润控股MTN001AAAA/AAA3.05(1.2bp)

1.65Y20宝武集团MTN001AAA/AAA3(3bp)

1.66Y20中石化MTN003AAA/AAA2.93(2.2bp)

1.67Y18京能源MTN001AAA/AAA3(2.8bp)

1.68Y21上海大众MTN002AAA/03.33(5.4bp)

1.72Y21广核电力MTN002AAA/AAA3(1.4bp)

1.72Y20汇金MTN008AAAA/AAA2.98(6.3bp)

1.81Y21中化股MTN003AAA/AAA3.1(1.8bp)

1.85Y18京国资MTN003AAA/AAA3.03(1.9bp)

1.86Y21中石化MTN003AAA/02.95(1.2bp)

1.89Y20汇金MTN009AAAA/AAA2.99(4.8bp)

1.9Y18国开投MTN001BAAA/AAA3.02(-0.8bp)

1.9YN20中广核MTN004AAA/AAA3.28(1.6bp)

1.94Y18陕煤化MTN003AAA/AAA3.35(1.7bp)

2.04Y(休2)20陕延油MTN003AAA/AAA3.3(1.4bp)

2.05Y20汉江国资MTN003AAA/AAA3.27(1.1bp)

2.06Y20洋河MTN001AAA/AAA3.2(-1bp)

2.22Y20华发集团MTN006AAA/AAA4.51(5.8bp)

2.29Y21无锡建投MTN002AAA/AAA3.23(-2.4bp)

109D2Y19中石油MTN002AAA/AAA2.8行权(15.8bp)

2.31Y19招商局MTN001AAA/AAA3.1(0.2bp)

2.37Y21南电GN001AAA/AAA3.03(2bp)

2.48Y21苏国资MTN002AAA/AAA3.13(1.9bp)

2.49Y(休1)21金地MTN003AAA/AAA3.55(1.4bp)

2.49Y19青岛城投MTN001AAA/AAA3.28(-0.3bp)

2.49Y21国电GN001AAA/AAA3.11(-0.8bp)

2.5Y19建发集MTN001AAA/AAA3.66(7.2bp)

2.53Y21长电MTN001AAA/AAA3.14(1.8bp)

2.72Y21宁沪高MTN001AAA/03.2(-1.9bp)

2.74Y21中铝集MTN002AAA/03.3(-2.5bp)

2.75Y21苏国信MTN005AAA/03.18(3.7bp)

2.88Y21中铁股MTN004AAA/AAA3.19(3.4bp)

2.89YN21中冶MTN002AAA/AAA3.6(-0.7bp)

2.93Y21深圳资本MTN001AAA/AAA3.39(3.4bp)

2.95Y21粤能源MTN001AAA/03.17(0.8bp)

2.99Y21河钢集MTN004(革命老区)AAA/AAA4.12(0.5bp)

3Y19华发集团MTN005AAA/AAA4.65(5.4bp)

1.16Y2Y20复星高科MTN004AAA/AAA5.95行权(-14.1bp)

1.16Y2Y19绍兴交投MTN004AAA/AAA3行权(1.1bp)

3.45Y20川高速MTN001AAA/AAA3.47(0.7bp)

1.55Y2Y20深业MTN002AAA/AAA3.05行权(2.8bp)

3.56Y(休1)20国盛MTN001AAA/AAA3.32(3.1bp)

2.49Y2Y21新长宁MTN001AAA/AAA3.33行权(4.6bp)

4.58Y21苏国信MTN002BAAA/03.49(1.7bp)

4.58Y19川发展MTN002BAAA/AAA3.59(4.1bp)

1.71Y3Y17河钢集MTN007AAA/AAA3.73行权(-0.2bp)

2.71Y2Y21武汉城建MTN001AAA/AAA3.34行权(2.8bp)

4.83Y21中石化MTN001AAA/03.41(-0.3bp)

4.9Y21成交投MTN001AAA/AAA3.69(-0.9bp)

4.93Y21成交投MTN002AAA/AAA3.7(-0.1bp)

4.99Y21晋焦煤MTN005AAA/04.03(1.7bp)

9.8Y21闽投MTN004AAA/AAA3.8(-1.1bp)

AA方面,

196D19青岛北城MTN001AA/AA3.15(19.1bp)

197D17徐州经开MTN002AA/AA3(4bp)

238DN17兴泸MTN001AA/AA3.39(-0.2bp)

275D17即墨城投MTN001AA/AA3.05(0.7bp)

307D17渝惠通MTN001AA/AA3.6(-10.9bp)

326D(休2)19广宇MTN001AA/AA4.6(-62.8bp)

342DN17余姚城投MTN002AA/AA3.45(-1.5bp)

1.15Y20百业源MTN002AA/AA3.49(20.1bp)

1.16Y19巨化MTN002AA/AA3.12(3bp)

1.37Y18蒙高路MTN001AA/AA3.5(6.9bp)

1.45Y18吴江经开MTN002AA/AA3.18(0.2bp)

1.47Y20许继电气MTN001AA/AA3.23(1.4bp)

1.55Y20国兴投资MTN001AA/AA3.24(3.2bp)

1.58Y20昆山国创MTN001AA/AAA3.22(0.2bp)

1.61Y20常德城投MTN002AA/AA3.4(-2.7bp)

1.66Y18名城建设MTN002AA/AAA3.28(3.6bp)

1.94Y18太仓资产MTN002AA/AA3.33(-0.1bp)

1.98Y18珠水环境MTN001AA/AA3.35(1bp)

2.05Y20新海连MTN002AA/AA4.55(0.2bp)

172D2Y19宜春交通MTN001AA/AA2.87行权(-2.4bp)

3.41Y20宿迁交通MTN001AA/AA3.93(-6bp)

1.99Y2Y20淮安交通MTN002AA/AA3.97行权(-0.3bp)

1.99Y2Y20临空港投MTN001AA/AA3.62行权(-0.6bp)

AA方面,

119D19鄂州城投MTN001AA/AA3.1(4.3bp)

287D19铜陵建投GN002AA/AAA3.05(-0.3bp)

1.32Y20金坛投资MTN001AA/AA5.11(0bp)

116D1Y20柳州建投MTN001AA/AA6.25行权(25.8bp)

1.57Y20紫坪铺MTN001AA/AAA4.09(0bp)

1.87Y2Y20郫国投MTN001AA/AA5.23行权(1bp)

38D2Y2Y18黄冈城投MTN002AA/AA3行权(-1.7bp)

2.33Y2Y21合川投资MTN001AA/AAA3.875行权(0.1bp)

2.33Y2Y21蔡甸城建MTN001AA/AA3.87行权(-0.5bp)

2.51Y2Y21庐江城投MTN001AA/AA4.3行权(4.6bp)

存单

存单一级发行量1113.3亿,除1M为休息日到期外,其余期限为工作日到期,3M、6M总体投资情绪稍好,但6M以上品种交投较为清淡。1M国股询在2.40%至2.45%,需求不佳,3M国股大行询在2.35%至2.50%,部分国股行提价至2.50%后募集情况较好,6M国股大行询在2.60%至2.65%,AAA城农商行询在2.60%至2.80%,1Y国股大行询在2.65%至2.77%,部分国股行发行价格在提价至2.77%后仍然需求不佳。

二级存单各期限成交活跃,上午各期限收益继续小幅上行趋势,午盘过后买盘逐渐活跃,收益率有所回落。月内到期国股成交在1.80%-1.85%,1M国股成交在2.75%-2.85%,不跨年12月到期国股成交在2.48%-2.51%,跨年方面,明年春节前到期国股成交在2.64%-2.70%,不跨一季度国股成交在2.69%-2.73%,9M国股成交在2.76%-2.81%,1Y国股成交在2.77%-2.80%。

企业债

今日企业债成交,1到3年期限继续估值加点成交。目前3年交易所,券商成交在3.10附近,个别资质稍弱得成交在3.30~3.40区间,收益调整比较到位了,成交逐渐放量。3年商金成交在3.02~3.08区间,永续类则上行至4.05位置。

AAA方面,

20D18南洋银行01AAA/AAA2.85(5bp)

27D(休1)16徐工02AAA/AAA2.8(-9.9bp)

42D18光大01AAA/AAA2.9(8.5bp)

45D18电投10AAA/AAA2.85(4.8bp)

45D18电投10AAA/AAA2.86(5.8bp)

58D16恒健02AAA/AAA2.79(0.1bp)

59D18华泰G1AAA/AAA2.66(-0.2bp)

61D(休1)18国yao01AAA/AAA2.8(3.5bp)

66D18首置03AAA/AAA3.6(15bp)

71D11国网01AAA/AAA2.65(9.5bp)

77D18民生银行02AAA/AAA2.6(2bp)

90D20光证G6AAA/AAA2.46(-10.5bp)

108D21国君S2AAA/A-12.65(11bp)

110D(休1)20申证01AAA/02.7(0.5bp)

115D21鲁资S1AAA/02.9(6.7bp)

142DG17龙湖1AAA/AAA3.03(9.6bp)

157D16龙湖03AAA/AAA3.01(4.2bp)

161D21皖能01AAA/AAA2.86(3.3bp)

162D17锡公01AAA/AAA2.86(2.3bp)

172D(休2)19华泰G1AAA/AAA2.75(6.7bp)

173D(休1)G18临港1AAA/AAA2.89(4.6bp)

180D(休1)19浦发银行小微债01AAA/AAA2.73(0bp)

188D(休2)19吉林银行小微债01AAA/AAA3.55(5bp)

196D12石油06AAA/AAA2.74(-2.1bp)

196D12石油07AAA/AAA2.75(-1.1bp)

198D17川投01AAA/AAA2.9(1bp)

200D(休2)19广州银行绿se金融债AAA/AAA2.8(2.1bp)

209D19南网01AAA/AAA2.8(3.1bp)

211D17南京银行绿se金融02AAA/AAA2.75(-2.8bp)

211D17南京银行绿se金融02AAA/AAA2.76(-1.8bp)

213D19华电01AAA/AAA2.81(2.8bp)

229D(休1)19信投C3AAA/AAA3.13(-2.7bp)

234D19国投01AAA/AAA2.81(1.9bp)

234D19国投01AAA/AAA2.82(2.9bp)

234D21中原S1AAA/A-12.89(3.2bp)

255D19航控04AAA/AAA2.88(-3.6bp)

257D(休1)19电控01AAA/AAA2.87(1.3bp)

264D(休1)19联通01AAA/AAA2.8(2bp)

269D19光大01AAA/AAA2.83(2.7bp)

273D21华泰S2AAA/A-12.8(9bp)

284D(休2)19招商银行小微债01AAA/AAA2.76(4bp)

290D19国电01AAA/AAA2.85(3.6bp)

294D19航控05AAA/AAA2.92(-1.4bp)

305D(休2)20长江04AAA/AAA2.88(5.3bp)

317D17电投14AAA/AAA2.85(2.9bp)

318D19宁波银行小微债01AAA/AAA2.76(-1.4bp)

351D17渝高01AAA/AAA2.94(-1.9bp)

353D19航控07AAA/AAA2.92(-2.3bp)

358D20招证G4AAA/AAA2.8(3bp)

360D19邮政03AAA/AAA2.85(2.4bp)

363D19唐新01AAA/AAA2.91(2.5bp)

1.05YNY(休1)17建材Y2AAA/AAA3.09(2.7bp)

1.06Y20中证21AAA/AAA2.84(5.2bp)

1.07Y17中冶01AAA/AAA2.94(4.8bp)

1.08Y20中证23AAA/AAA2.84(4.8bp)

1.11Y19兴业G1AAA/AAA2.86(-0.2bp)

1.14YN19铁建Y3AAA/AAA3.06(-0.7bp)

1.15Y18复星05AAA/AAA5.5(-11.3bp)

1.16Y17铁道18AAA/AAA2.8(-0.7bp)

1.21Y19交通银行02AAA/AAA2.84(8.4bp)

1.28Y20长电01AAA/AAA2.88(2.9bp)

1.33Y18紫金01AAA/AAA3.03(3.7bp)

1.35Y18铁道03AAA/AAA2.83(-0.4bp)

1.42YGC电投01AAA/AAA2.9(2.9bp)

1.44Y20宝钢01AAA/AAA2.96(2.1bp)

1.45Y20电信01AAA/AAA2.9(2.6bp)

1.45YN20中核Y3AAA/AAA3.05(1.7bp)

1.45Y13京投债AAA/AAA2.95(2.7bp)

1.46Y20北京银行小微债01AAA/AAA2.83(-2.9bp)

1.48Y18吉高02AAA/AAA3.44(-4.1bp)

1.48Y18合和01AAA/AAA3.14(1.3bp)

1.48YNY20华能Y1AAA/AAA3.15行权(-0.2bp)

1.49Y20邮政01AAA/AAA2.91(2.9bp)

1.49Y20邮政01AAA/AAA2.9(1.9bp)

![[脱发治疗种头发]脱发种植头发能行吗](http://img.meili163.com/tup/img2023.php?fl=4&wenzi=脱发治疗种头发)

发表评论